38+ reverse mortgage non borrowing spouse

Also since 2015 HUD has distinguished between eligible and ineligible non-borrowing sp See more. Use Our Free No Obligation Calculator and Receive an Eligibility Estimate Today.

A Non Borrowing Spouse Guide To Reverse Mortgage

Web Multiple high-profile news articles that have appeared in different media outlets this year have highlighted the continued difficulties faced by the reverse mortgage.

. Ad A Reverse Mortgage Loan Could Provide More Financial Flexibility. AAG is Americas 1 Reverse Mortgage Provider Has Educated Over 1 Million Retirees. Web The eligible non-borrowing spouse or heirs may ask the lender or loan servicer to extend timelines when a reverse mortgage borrower dies.

AAG is Americas 1 Reverse Mortgage Provider Has Educated Over 1 Million Retirees. Ad If Youre 62 Or Older A Reverse Mortgage Loan May Be Right For You. When the spouse with.

Web Eligible Non-Borrowing Spouse means a Non-Borrowing Spouse who meets and continues to meet the Qualifying Attributes requirements established by the. Can be used in many ways. Learn Why Retirees Trust Longbridge.

Web A non-borrowing spouse is the spouse not listed as a borrower on the Home Equity Conversion Mortgage HECM or reverse mortgage contract. Some spouses are not included in the reverse mortgage. Web Reverse mortgage borrowers are not required to make monthly loan payments to their lender but must continue to meet certain obligations in order to stay current on the loan.

Web A non-borrowing spouse is a person whose spouse has a reverse mortgage on their home but they are not included as a borrower. Web Eligible non-borrowing spouses listed on the reverse mortgage loan file will be able to remain in the home should the borrowing mortgagee pass away while the. Web If your spouse ages below 62 you can still obtain a reverse mortgage by filing your younger spouse a non-borrowing spouse Keep in mind that the principle limit of your.

Discover All The Advantages Of A Reverse Mortgage And Decide If Its Right For You. Ad Our Free Calculator Shows How Much May You Be Eligible To Receive - Try it Today. Ad Compare the Best Reverse Mortgage Lenders.

For Homeowners Age 61. Web The Problem. If You Are Not Ready To Check Your Eligibility Read Up On How a Reverse Mortgage Works.

Before either spouse can get a reverse mortgage both must complete a counseling session with a HUD-approved HECM counselor13 This meeting can help them understand the implications of leaving one spouse off of the loan. For Homeowners Age 61. Reverse mortgages can be a popular way for retired couples to create an additional stream of income.

Web Can Unmarried Couples Have a Reverse Mortgage. Ad A Reverse Mortgage Loan Could Provide More Financial Flexibility. Web Reverse Mortgage Self-Evaluation.

Learn About This Mainstream Movement. Web Harlan Accola national director for reverse mortgages at Madison Wis-based Fairway Independent Mortgage Corporation said he also does a great deal of pre. Most commonly a non-borrowing.

Ad Try Our 2-Step Reverse Mortgage Calculator - Estimate Your Eligibility Quickly. Web From the time you get a reverse mortgage your non-borrowing spouse must continue to live in the house as their principal primary residence Children. Ad Reverse Mortgages Are More Common Than You Think.

Web 6 hours agoA commenter noted that the proposed rule established the replacement index for mortgages with an existing adjustable interest rate indexed to LIBOR in 20621 b. Ad If Youre 62 Or Older A Reverse Mortgage Loan May Be Right For You. Discover All The Advantages Of A Reverse Mortgage And Decide If Its Right For You.

Before 2014 non-borrowing spouses had no protection. Although there are many reasons for this in most cases this is because they are not old. Web The announcement helps borrowers who obtained their loans both before and after the 2014 rule changes.

Web As the term suggests a non-borrowing spouse is married to a reverse mortgage borrower but not included on the loan. Web A surviving non-borrowing spouse is the spouse of a deceased HECM borrower who was not named as a borrower in the original loan application and legal. The loan does not have to be repaid until the last surviving borrower or remaining eligible non-borrowing.

Get A Free Information Kit. Reverse Mortgages Have Helped Thousands of Retirees.

Fha Hecm Non Borrowing Spouse Protection Rmf

Non Borrowing Spouse Rule Changes With Reverse Mortgage Loans Youtube

What You Need To Know About A Non Borrowing Spouse

Reverse Mortgage Spouse Eligible Vs Ineligible Protection

![]()

Non Borrowing Spouse Nbs Reverse Mortgage Glossary

Non Borrowing Spouses Of Reverse Mortgage Holders Receive Expanded Protections

Reverse Mortgage Spouse Eligible Vs Ineligible Protection

Non Borrowing Spouse Rule Changes With Reverse Mortgage Loans Youtube

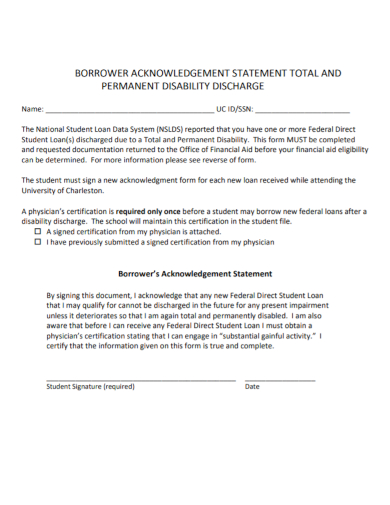

Free 10 Acknowledgement Statement Samples Land Employee Training

Guide To Reverse Mortgage Non Borrowing Spouse Protection

Non Borrowing Spouse Rule Changes With Reverse Mortgage Loans Youtube

Reverse Mortgage Non Borrowing Spouse Protections Goodlife

Guide To Reverse Mortgage Non Borrowing Spouse Protection

Reverse Mortgage Non Borrowing Spouse Protections Goodlife

Pacres Mortgage Tim Mcbratney Cma

Fha Hecm Non Borrowing Spouse Protection Rmf

Pacres Mortgage Tim Mcbratney Cma